The OECD’s proposed reform will fail to generate meaningful additional tax revenue, especially for developing countries

Today, the OECD has presented its impact analysis of its proposed reform to address the tax avoidance by multinational corporations. If ambitious enough, it could bring a significant change to century old international tax rules unfit for the digital age and generate substantial additional revenues.

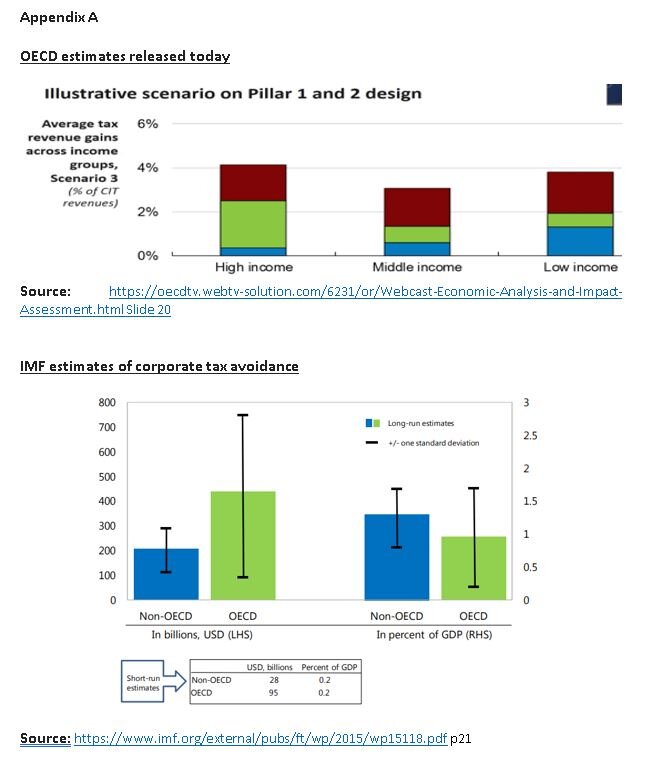

According to the OECD impact analysis, its proposed reform is estimated to generate global tax revenue gain up to 4% of global corporate tax revenue or $100bn annually. This is at the lower end of the OECD’s own estimate of corporate tax avoidance ($100-240bn) and much lower than the International Monetary Fund’s estimates of $600bn of corporate tax revenue lost every year through tax avoidance by multinationals ($400bn for OECD countries, $200bn for non-OECD countries).

The distributive implications of this proposal are also problematic, as high-income countries are expected to benefit marginally more than middle and low income countries (see graphs in Appendix A), despite middle and low income countries facing proportionally the highest losses from corporate tax avoidance under the current rules, as a percentage of GDP.

As it stands, the reform proposal would fail to meaningfully address tax avoidance by multinationals and deliver minimal redistribution of taxing rights and will only achieve a small fraction of its objectives.

The full set of data to the OECD estimates is yet to be made public and that will apparently not happen soon. Countries will therefore be asked to sign up to the entire BEPS plan without the economic impact being made publicly available for scrutiny.

Publishing this information is essential for countries and their citizens to understand who the winners and losers are.

Without this, the OECD Inclusive Framework members (a group of 137 countries across the globe) cannot fully evaluate whether it is in their interests to sign up to this reform.

The OECD impact analysis published today demonstrate again that thus far, reform proposals have fallen short of expectations. What is currently being negotiated and lead by the OECD would introduce even greater complexity, leaving the current dysfunctional transfer pricing system (designed in the 1920s) largely in place, while adding a bolt-on solution just for a small percentage of global profits and a yet to be defined global minimum tax.

The proposal falls short of the comprehensive solution advocated by ICRICT for a move towards global formulary apportionment and a global minimum tax of 25% and the proposal by many developing countries through The Intergovernmental Group of Twenty-Four (G24), which coordinates the position of developing countries on monetary and development issues, for fractional apportionment of multinationals profits.

Addressing global challenges such as rising inequality, climate change, development and forced migration requires a community of well-funded States willing to collaborate effectively. There will be no sustainable solutions to these challenges without fairer global tax rules.

Read our latest report about how to change the way multinationals are taxed, with solutions that are in the interest of both developed and developing countries

MEDIA CONTACT: LAMIA OUALALOU

loualalou@gmail.com or by WhatsApp +52 1 55 54080974.